kiraramsay5558

About kiraramsay5558

24-Hour Personal Loans No Credit Check: A Comprehensive Information

In today’s fast-paced world, financial emergencies can arise at any second, and having quick access to funds can be essential. For people with much less-than-good credit histories, conventional loan choices will not be viable. That is where 24-hour personal loans with no credit checks come into play. This report delves into what these loans are, how they work, their benefits, drawbacks, and vital issues for borrowers.

Understanding 24-Hour Personal Loans

24-hour personal loans are short-time period loans that can be processed and disbursed inside a single day. These loans are typically designed for people who want fast money for unexpected expenses, equivalent to medical bills, car repairs, or urgent household needs. The attraction of those loans is further enhanced once they come with no credit check, making them accessible to a broader vary of borrowers.

How Do They Work?

The applying process for 24-hour personal loans with no credit check is normally straightforward. Borrowers can apply online or in-individual at a lending institution. Here’s a step-by-step breakdown of how these loans sometimes work:

- Software Submission: Borrowers fill out an application kind, providing personal data reminiscent of identify, deal with, revenue, and employment details.

- Verification: The lender may verify the applicant’s id and income through documents like pay stubs or bank statements. Nonetheless, they don’t perform a standard credit check.

- Loan Approval: If the appliance meets the lender’s criteria, approval will be granted quickly, typically inside a few hours.

- Fund Disbursement: As soon as approved, the funds are often deposited immediately into the borrower’s bank account inside 24 hours.

Benefits of 24-Hour Personal Loans No Credit Check

- Quick Access to Funds: The most significant advantage is the speed at which funds are made available. Borrowers can entry cash quickly to deal with pressing financial needs.

- No Credit Check: Since these loans do not require a credit check, they’re accessible to individuals with poor credit scores or those who’re new to credit.

- Easy Application Process: The applying process is usually simplified, requiring minimal documentation and decreasing the time spent on approval.

- Flexibility: Borrowers can use the funds for various purposes, together with medical emergencies, residence repairs, or different unexpected expenses.

Drawbacks of 24-Hour Personal Loans No Credit Check

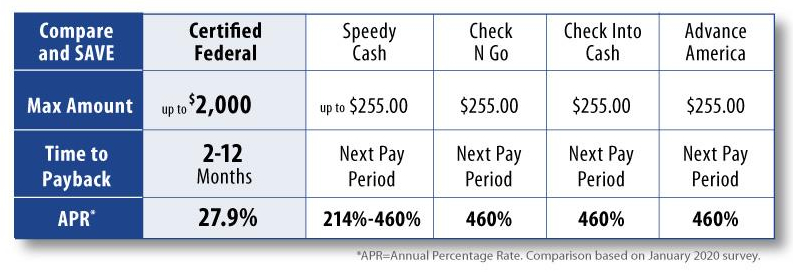

- Excessive Interest Rates: One of many most important downsides is the high-curiosity rates related to these loans. Lenders compensate for the elevated risk of lending to individuals with poor credit score by charging greater charges.

- Brief Repayment Terms: These loans typically come with quick repayment intervals, usually starting from a number of weeks to some months, which can result in financial strain if borrowers are unable to repay on time.

- Potential for Debt Cycle: Borrowers could find themselves in a cycle of debt, as they might must take out additional loans to repay the original amount, resulting in a spiral of borrowing.

- Limited Loan Amounts: The amount that can be borrowed is often lower than traditional loans, which may not be adequate for larger bills.

Vital Issues for Borrowers

Earlier than opting for a 24-hour personal loan with no credit check, borrowers ought to consider the next:

- Assess Financial Wants: Clearly outline the purpose of the loan and be certain that it is necessary. Consider whether there are different solutions that could be less pricey.

- Compare Lenders: Not all lenders provide the identical phrases. It is crucial to shop round and evaluate interest charges, charges, and repayment phrases from a number of lenders.

- Read the Fantastic Print: Perceive all phrases and situations related to the loan. Listen to charges, penalties for late payments, and the entire cost of the loan.

- Have a Repayment Plan: Earlier than taking out a loan, have a transparent plan in place for a way and when you will repay it. This might help avoid falling right into a debt cycle.

- Consider Options: Discover different options corresponding to credit unions, peer-to-peer lending, or personal loans from buddies or family. These could provide better phrases and lower curiosity charges.

Conclusion

24-hour personal loans with no credit check can be a lifeline for people facing financial emergencies. If you cherished this write-up and you would like to acquire much more data relating to loans no credit check (Bestnocreditcheckloans.com) kindly take a look at our internet site. Nonetheless, they come with significant risks, together with high-curiosity charges and the potential for debt cycles. Borrowers must conduct thorough analysis, consider their financial state of affairs, and have a stable repayment plan in place before committing to these loans. By being knowledgeable and cautious, borrowers could make better financial selections that align with their wants and circumstances. Always do not forget that whereas fast access to funds can be tempting, it is essential to weigh the professionals and cons rigorously to avoid long-time period monetary repercussions.

No listing found.